Life insurance is an important part of financial planning, providing individuals and their families with financial protection and security in the event of unexpected circumstances. The Telangana State Government produced the “TSGLI Policy Bond” Scheme which recognizes the importance of life insurance for govt employees by Telangana State Government Life Insurance Department. In this article, we will explore the details of TSGLI policies, including features, benefits, policy bonds, and annual slips.

Table of Contents

Understanding TSGLI Scheme

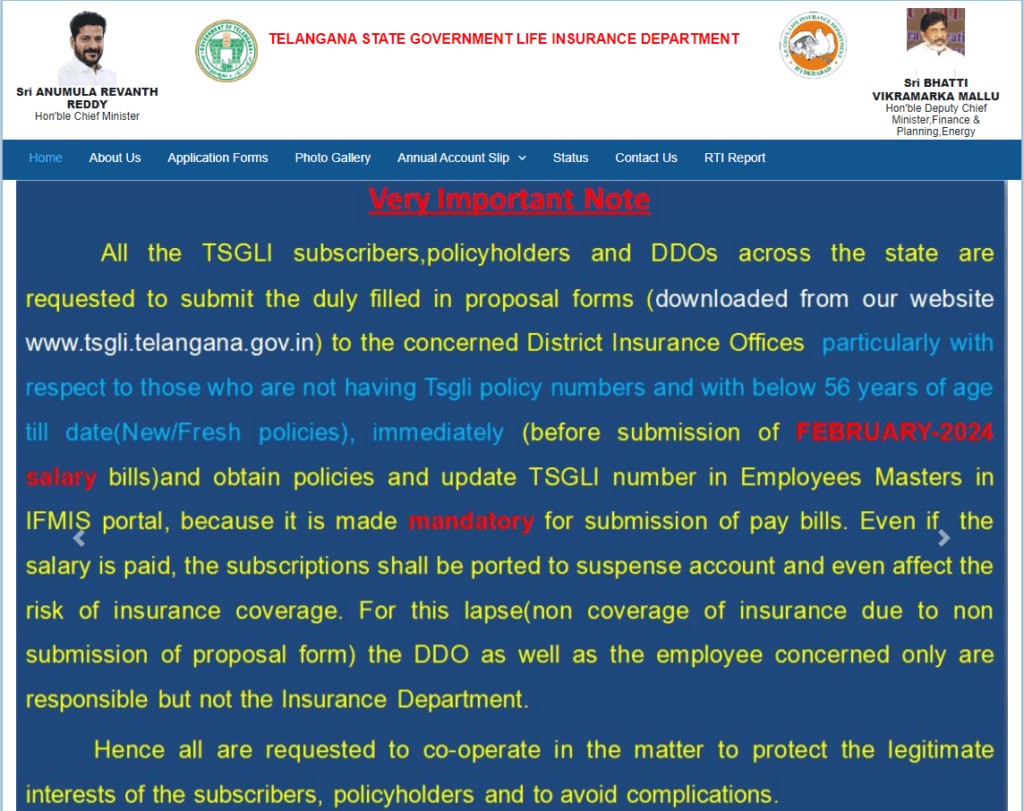

The Telangana State Government Life Insurance (TSGLI) scheme is a life insurance program specifically designed for government employees in the state of Telangana. It is a mandatory scheme that provides financial protection to employees and their families. TSGLI is a great policy that matures upon the employee’s retirement, for a secure future.

Eligibility Criteria for TSGLI Scheme

To be eligible for a TSGLI policy, employees must meet the following criteria:

- The employee must be within the age range of 21 to 53 years.

- The employee must be a government employee in the state of Telangana.

Features of TSGLI Policies

TSGLI policies offer several attractive features that make them an excellent choice for government employees. Let’s take a look at some of the key features:

- Low Premium Rates: TSGLI policies offer low premium rates compared to other insurance options, making them affordable for employees.

- Guaranteed Maturity: TSGLI policies mature upon the employee’s retirement, ensuring a lump sum payment at the end of the policy term.

- Non-Lapsable Policies: TSGLI policies do not lapse as long as the premiums are paid regularly. This ensures that employees and their families are always protected.

- Tax Benefits: The premium paid towards TSGLI is exempted from income tax under section 80C of the Income Tax Act. This provides additional savings for employees.

- Attractive Bonus Rates: TSGLI policies offer attractive bonus rates, with the current rate being Rs. 100/- for every Rs. 1000/- Sum Assured per annum.

- Loan Facility: TSGLI policies provide the option to avail loans up to 90% of the surrender value, ensuring financial flexibility for policyholders.

TSGLI Policy Bond

The TSGLI policy bond is a important document that serves as proof of coverage under the TSGLI scheme this scheme can secure your future. It contains important information such as the employee’s name, coverage amount, policy number, nominee details, and the terms and conditions of the coverage. The policy bond must be kept safe as it is required for various purposes, including maturity claims and loan applications. You can TSGLI bond search by providing policy details.

How to Download TSGLI Bond PDF

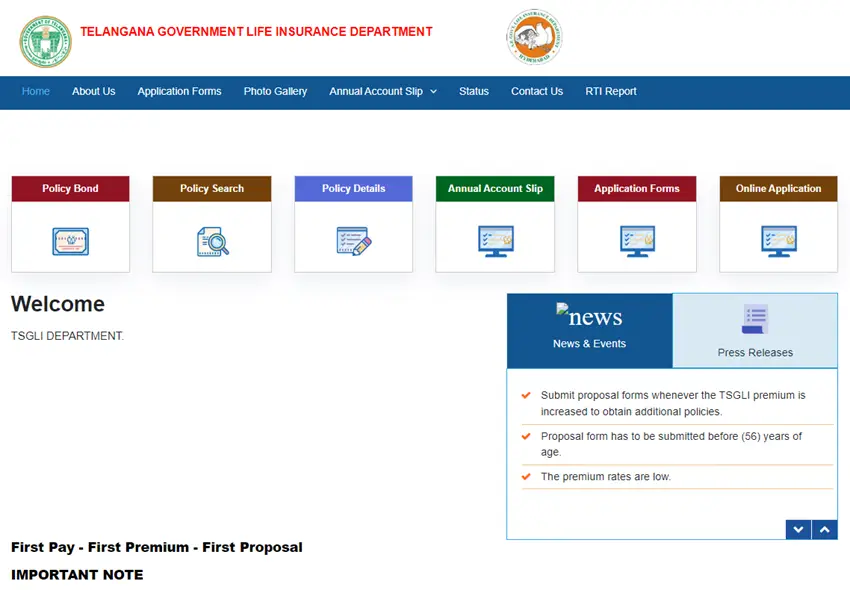

To TSGLI Bond Download PDF of your TSGLI Policy Bond Document, Downloading is a simple process that can be done online. Here are the steps to TSGLI bond download PDF of your TSGLI policy bond:

- Visit the official website of TSGLI. (http://tgli.telangana.gov.in/)

- Login to your account using your policyholder’s name, date of birth, policy number, and registered mobile number.

- Navigate to the policy bond section and click on the “Download” button.

- Review the details of the policy bond and ensure its accuracy.

- Save the policy bond on your device and take a printout for future reference.

- Keep the policy bond in a safe place to avoid any loss or damage.

Download TSGLI Related Forms

| RECENT NOTICE | Download Link |

|---|---|

| Telangana Government Life Insurance Department – Automation of TGLI Policy Holder Services – Obtaining TGLI Policy Number and It is Updation in IFMIS Portal – Ensuring Proper Insurance Coverage – Certain Guidelines Communicated – Regarding | https://drive.google.com/file/d/1hglAKFXivH4Jiv0SEyWi7CXj_2Mkq9Mz/view?usp=sharing |

Here are some Useful Web links Regarding the TSGLI

| TSGLI ONLINE | LINKS |

|---|---|

| TSGLI ANNUAL ACCOUNTS SLIPS | http://tgli.telangana.gov.in/AnnualReport.aspx |

| Policy No. Search | http://tgli.telangana.gov.in/PolicyFinder.aspx |

| TSGLI POLICY DETAILS | http://tgli.telangana.gov.in/PolicyDetails.aspx |

| GET POLICY BOND | http://tgli.telangana.gov.in/Tsgli_bond.aspx |

| STATUS OF POLICY (Loan, Claim & Issue of Policy) | http://tgli.telangana.gov.in/StatusofApplicant.aspx |

| Missing Credits | http://tgli.telangana.gov.in/MissingCredits.aspx |

| Circulars and Gos | http://tgli.telangana.gov.in/AnnualReport.aspx |

| GIS Calculator | http://tgli.telangana.gov.in/GISCalculator.aspx |

| Online Application | http://tgli.telangana.gov.in/Index.aspx#login-modal |

| Application Forms | http://tgli.telangana.gov.in/Downloads.aspx |

| Annual Account Slip | http://tgli.telangana.gov.in/AnnualReport.aspx |

Importance of TSGLI Policy Bond

The TSGLI policy bond is an important document It is required for various purposes, including:

- Maturity Claims: The policy bond is necessary to claim the maturity amount at the end of the policy term.

- Loan Applications: The policy bond is required when applying for a loan against the TSGLI policy.

- Nominee Claims: In the event of the policyholder’s demise, the nominee can claim the sum assured by submitting the policy bond.

Keeping the policy bond safe and accessible ensures a smooth process for all these transactions.

TSGLI Annual Slips 2024

TSGLI provides annual account slips to policyholders, which provide a summary of their policy details for a specific year. The annual slips contain information such as the policyholder’s name, policy number, premium paid, bonus earned, and other relevant details. These slips are important for policyholders to keep track of their premium payments and bonus savings.

How to Download TSGLI Annual Slips 2024

To Download TSGLI Annual Slips for the year 2024 is a Simple Process. Follow these Steps to Download your Annual Slips:

- Visit the official TSGLI website. (http://tgli.telangana.gov.in/)

- Log in to your account using your policyholder’s name, date of birth, policy number, and registered mobile number.

- Navigate to the “Annual Slips” section and select the year 2024.

- Click on the “Download” button to save the annual slips on your device.

- Review the details on the slips and ensure their accuracy.

- Keep the annual slips for future reference and record-keeping.

TSGLI Maturity Value Bonus Calculator

The TSGLI Maturity Value Bonus Calculator is a useful tool that helps policyholders estimate the maturity value and bonus earnings of their TSGLI policy. By inputting relevant details such as the policy term, sum assured, and premium paid, policyholders can get an approximate idea of the maturity amount they can expect at the end of the policy term.

How to Use the TSGLI Maturity Value Bonus Calculator

Using the TSGLI Maturity Value Bonus Calculator is a simple process. Follow these steps to estimate your policy’s maturity value and bonus earnings:

- Visit the TSGLI website. (http://tgli.telangana.gov.in/)

- Look for the “Maturity Value Bonus Calculator” section.

- Input the required details such as policy term, sum assured, and premium paid.

- Click on the “Calculate” button to generate the estimated maturity value and bonus earnings.

- Review the calculated results and use them for future financial planning.

TSGLI Indemnity Bond

In few cases, policyholders may need to submit an indemnity bond to the TSGLI authorities. An indemnity bond is a legal document that indemnifies the TSGLI department against any loss or liability arising due to the issuance of a duplicate policy bond or other related matters. The bond ensures that the policyholder takes full responsibility for any issues related to policy duplication or misuse.

How to Submit a TSGLI Indemnity Bond

If you are required to submit a TSGLI indemnity bond, follow these steps:

- Download the TSGLI indemnity bond form from the official website: http://tgli.telangana.gov.in/

- Fill in the required details, including your policyholder’s name, policy number, and the reason for submitting the bond.

- Sign the indemnity bond in the presence of a witness.

- Submit the completed indemnity bond to the TSGLI office or upload it on the official website, as per the instructions provided.

- Keep a copy of the indemnity bond for your records.

Frequently Asked Questions (FAQs)

To address common queries regarding TSGLI policies, here are some frequently asked questions and their answers:

Q1. What are the rules for TSGLI?

The regulations governing the Telangana State Government Life Insurance (TSGLI) mandate compulsory enrollment for government employees in Telangana. Employees are required to pay premiums until their retirement. In return, the scheme ensures the payout of the sum assured either upon maturity or in the unfortunate event of the policyholder’s death. These rules establish a structured framework, highlighting the commitment to financial security and protection for government employees participating in the TSGLI scheme.

Q2. What is the full form of TSGLI in salary?

The full form of TSGLI is Telangana State Government Life Insurance.

Q3. How can I download my TSGLI Policy Bond?

To download your TSGLI Policy Bond, access the official website, tsgli.telangana.gov.in, and follow a simple, user-friendly process, after visiting the website, you can see the “TSGLI Policy Bond” link in the menu section. Enter your correct policy number and the suffix (if applicable). Input the number generated in the image and click the “Get Policy Bond” button. Your TSGLI policy bond will then be displayed on your screen. It’s advised to review the details, and if accurate, proceed to download and print the bond for future reference.

Q4. Is there a charge for downloading the policy bond?

No, there is no charge associated with downloading the TSGLI Policy Bond. The entire process is free of cost, allowing policyholders to access their policy details and documentation multiple times without incurring any fees. The Telangana State Government has facilitated a user-friendly and cost-effective online platform for employees to conveniently download their policy bonds. This initiative is aimed at ensuring accessibility and ease of use for all government employees participating in the TSGLI scheme, promoting financial awareness and preparedness.

Q5. Can I download my policy bond without logging in?

Yes, it is possible to download the TSGLI Policy Bond without logging in. However, it is required that you have the policy number on hand to initiate the download process. By providing the correct policy number during the download procedure, policyholders can access and obtain their policy bond without the need for additional login credentials. This approach simplifies the process, offering convenience to users who may not have an active account on the official TSGLI website while maintaining the security of the policyholder’s information.

Q6. What are the requirements for downloading the TSGLI policy bond?

To download the TSGLI Policy Bond 2024, policyholders need specific details for authentication. These include the policyholder’s name, date of birth, policy number, and the registered mobile number associated with the policy. It’s essential to have all these details available before initiating the download process. Ensuring the correct information is entered during the download is crucial for obtaining the correct policy bond. By having these details on hand, policyholders can seamlessly access and download their TSGLI Policy Bond from the official website.

Q7. Why is having a TSGLI Policy important?

The TSGLI Policy is important as it serves as a financial planning tool for government employees in Telangana. Life is unpredictable, so everyone needs a life insurance policy. In the unfortunate event of the policyholder’s death, the TSGLI Policy ensures that their family is shielded from financial difficulties. This coverage of mandatory savings schemes, such as GPF/EPF and GIS, offers an additional layer of security. By having a TSGLI Policy, government employees can secure their family’s financial future, allowing them to face life’s hesitations with confidence.

Q8. How can I check my TSGLI Policy Details?

First, visit the website and navigate to the “TSGLI Policy Details” section on the homepage. Once there, enter your correct policy number, date of birth, and the number generated in the image. Click on the “View Details” button, and your TSGLI Policy Details will be displayed on your device screen. After verifying the information, you can proceed to download and print your policy details for future reference.

Conclusion

In conclusion, the Telangana State Government Life Insurance (TSGLI) policies stand as a trustworthy life insurance scheme specifically for government employees in Telangana. The scheme has several key benefits, such as low premium rates, guaranteed maturity, tax benefits, and competitive bonus rates, which will provide financial security. It is important employees need to understand TSGLI policies, including a comprehensive policy bond, annual slips, and other relevant aspects.